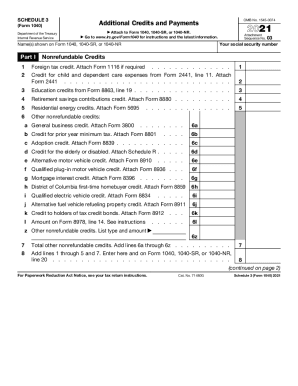

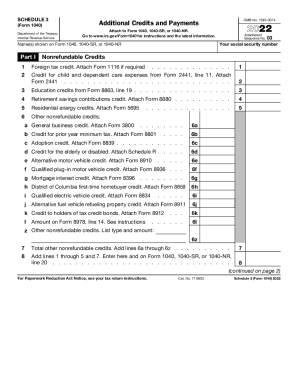

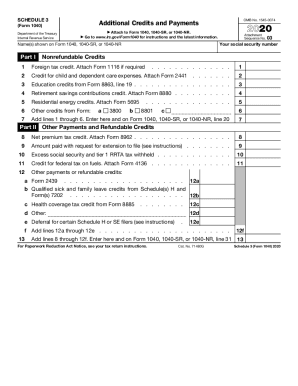

2024 Form 1040 Schedule 3 Line

2024 Form 1040 Schedule 3 Line – The Schedule 3 tax form is part of the 1040 tax return. Taxpayers who are eligible to claim nonrefundable credits must complete Schedule 3 and attach it to their 1040 return. Nonrefundable credits . Form 1040, Schedule C, Line 1 Report all money you collected in your business on Line 1 of Schedule C. This amount should include all commercial sales taxes you collected. You do not need to .

2024 Form 1040 Schedule 3 Line

Source : studentaid.govSchedule 3: Fill out & sign online | DocHub

Source : www.dochub.com1040 (2023) | Internal Revenue Service

Source : www.irs.gov2023 schedule 3: Fill out & sign online | DocHub

Source : www.dochub.comSchedule 3 2021 2024 Form Fill Out and Sign Printable PDF

Source : www.signnow.comIRS 1040 Schedule 3 2022 2024 Fill and Sign Printable Template

Source : www.uslegalforms.comSchedule 3 2020 2024 Form Fill Out and Sign Printable PDF

Source : www.signnow.comSchedule 3: Fill out & sign online | DocHub

Source : www.dochub.com1040 (2023) | Internal Revenue Service

Source : www.irs.govWhere To Find My 2022 Tax Information (2024–25) | Federal Student Aid

Source : studentaid.gov2024 Form 1040 Schedule 3 Line Where To Find My 2022 Tax Information (2024–25) | Federal Student Aid: Every dollar you win from gambling should be reported to the IRS, otherwise you could be fined or even go to jail. . The result is net profit or loss and is recorded on Line 31 of Schedule C and also on Line 12 of IRS Form 1040 as business income. If a business owner files additional Schedule C forms for other .

]]>.png)

.png)